Switching to solar energy is a smart move. Not only does it lower your electricity bills, but it also comes with a big perk: the solar tax credit. This credit allows homeowners to save thousands of dollars on their taxes when they install solar panels. But here’s the thing if you claim the solar tax credit, the IRS wants to make sure you really qualify.

So, how does the IRS verify solar credit? Let’s break it down step by step in a way that’s easy to understand.

What Is the Solar Tax Credit?

The solar tax credit, also called the Residential Clean Energy Credit, is a program that lets you deduct 30% of your solar installation costs from your federal taxes.

Imagine you spend $20,000 on solar panels. With the credit, you could save $6,000 on your tax bill. That’s like the government giving you a huge discount for choosing clean energy.

But there are a few rules:

- You must own the solar system (leasing doesn’t count).

- It has to be installed in a home you own in the U.S.

- You must have a tax bill big enough to use the credit.

This credit is not forever, it’s set to last at 30% through 2032. After that, it may shrink unless new laws extend it.

How Do You Claim the Solar Tax Credit?

Claiming the solar tax credit is not complicated, but you do need to follow the steps carefully.

You will use a special form called IRS Form 5695 (Residential Energy Credits). On this form, you’ll list how much you spent on your solar system and calculate your credit. Then, you’ll transfer that number to your main tax return (Form 1040).

What you will need:

- The total cost of your solar panels and installation

- Proof that you paid for it during the tax year

- The date your system started working

Many people make mistakes like forgetting some costs (wiring, permits, or batteries powered by solar also count), claiming in the wrong year, or trying to claim when they don’t own the panels. Those errors can cause the IRS to question your return.

How the IRS Verifies Your Solar Credit

Now comes the big question: how does the IRS check if your claim is real?

When you file, the IRS does not usually ask for proof right away. They trust that taxpayers are being honest. But if something seems off, your return might get flagged for review.

Here is how the process works:

- You file your tax return with Form 5695.

- The IRS runs your return through its system.

- If something looks unusual (like a huge solar credit compared to your income), they may send you a letter.

- The letter will ask for proof, things like receipts, contracts, or photos.

- If you send what they need, your credit gets approved. If not, the IRS may deny or adjust it.

Think of it like a teacher checking your homework. You do not just say, “I did it.” You have to show the work.

Documents the IRS Looks For

If the IRS wants proof, you will need to show them you really bought and installed solar panels. The best documents to keep include:

- Invoices and contracts from your installer

- Receipts or bank statements showing you paid

- Utility interconnection agreements, proving your system is connected to the grid

- Certificates or inspection reports showing the system is working

- Photos of your panels on your roof (sometimes requested)

The IRS does not need a shoebox of papers, but keeping a neat digital and physical folder will save you stress if they ever ask.

IRS Red Flags to Avoid

There are a few things that can make the IRS suspicious:

- Claiming without proof: Saying you installed panels but having no receipts or documents.

- Overstating costs: Claiming your $15,000 system costs $25,000 to get a bigger credit.

- Leasing panels: If you lease, the credit belongs to the company that owns the panels, not you.

- Wrong year claims: If your panels were not installed and working by December 31, you can’t claim the credit until the next year.

The IRS uses computers to spot unusual claims. If something does not match average costs or income levels, they will likely double-check.

What Happens If the IRS Questions Your Claim?

If your return is flagged, don’t panic. The IRS usually just wants extra paperwork. You will get a letter (like a CP2000 notice) asking for details.

Here is what you do:

- Read the letter carefully to see what they’re asking.

- Send copies of your receipts, contracts, and proof of installation.

- Wait for them to review.

If everything checks out, you are all set. If not, they may reduce or deny your credit. In rare cases, if they think you tried to cheat, you might face penalties.

But here is the truth: as long as you keep your documents, you have nothing to worry about.

Tips to Stay Safe with the IRS

Want to make sure your solar tax credit goes smoothly? Follow these tips:

- Keep every receipt, invoice, and contract.

- Store digital copies in case paper ones get lost.

- Work with certified solar installers who provide proper paperwork.

- Double-check IRS Form 5695 before filing.

- Do not try to stretch the truth about costs.

Think of it like building a strong case. The more proof you have, the easier it is to win.

Why a Tax Professional Might Help

While you can claim the credit on your own, hiring a tax preparer can make things easier. A professional:

- Knows exactly how to fill out Form 5695

- Spot mistakes before you file

- Saves you time and stress

- Can help if the IRS asks for more proof

It’s like having a coach on your team, they guide you so you don’t miss out on money or get into trouble.

Benefits of Solar Beyond the Tax Credit

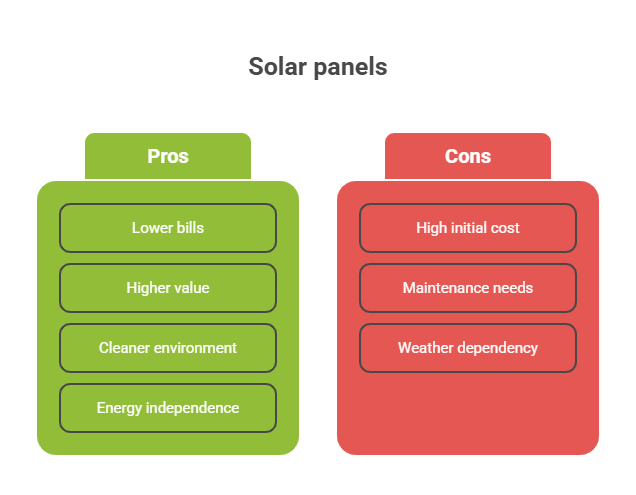

The tax credit is a huge bonus, but solar panels bring benefits that last for years:

- Lower energy bills: Many families save thousands over time.

- Higher home value: Buyers like homes with lower utility costs.

- Cleaner environment: Every solar panel reduces pollution.

- Energy independence: With solar batteries, you can keep the lights on even when the grid goes down.

So, even if the credit did not exist, solar would still be a smart investment.

Final Thoughts

The IRS verifies solar tax credits by checking documents like receipts, contracts, and proof of installation. As long as you keep records and follow the rules, you will have no problem claiming your credit.

Solar power is more than just a tax break it is an investment in your wallet, your home, and the planet. If you are ready to make the switch, do it responsibly, keep your paperwork safe, and enjoy the benefits for years to come.

FAQs

1. What form do I need to claim the solar tax credit?

You will need IRS Form 5695 and then transfer the number to your Form 1040.

2. Can I claim the credit if I lease my solar panels?

No. Only owners can claim the credit. If you lease, the company gets it.

3. How long will the solar tax credit last?

The full 30% credit runs until 2032. After that, it may shrink unless extended.

4. What happens if the IRS denies my claim?

They will send you a letter. If you cannot provide proof, the credit is removed, and you may owe taxes.

5. Can I claim the credit on a second home?

Yes, as long as it’s a home you own in the U.S. and not a rental property.

RELATED POST: Manatee Insurance Exchange: What You Need to Know Before Signing Up

GIPHY App Key not set. Please check settings